-

Devising your retirement plan: Start early and maximise returns

May 03, 2019

-

The 4% rule is an often quoted rule-of-thumb to know how much we will need in retirement. What is the 4% rule? The 4% in the rule refers to a retiree’s withdrawal rate: the amount of money one might withdraw annually from the starting value of your portfolio of stock and bonds in retirement.

For example, if you have $250,000 when you retire, the 4% rule would say that you could withdraw about 4% of that amount, or $10,000, the first year of retirement. You could then increase that amount with inflation, and still have a high probability that a balanced portfolio of stocks and bonds would last for at least 30 years.

Life expectancy plays an important role in determining if a 4% rate will be sustainable, as retirees who live longer need their portfolios to last longer, and healthcare costs and living expenses rise over time. A Singapore resident’s life expectancy, for those reaching age 65, currently stands at 86 years. That means that it would be prudent to plan for a 25 or 30 year retirement if one retires at 65. If one intends to retire earlier, it would make sense to extend that retirement period correspondingly.

Using the 4% rule, someone who is looking to have a $2,000 per month or $24,000 per annum income at retirement would need to multiply that required annual income by 25 times, resulting in a required retirement fund size of $600,000.

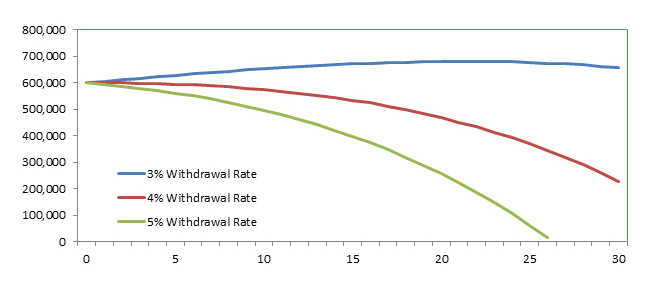

Retirement Fund Drawdown Rate – a 4% rate seems safe for 30-year horizon

Simulations based on 4% portfolio return, 2% inflation.

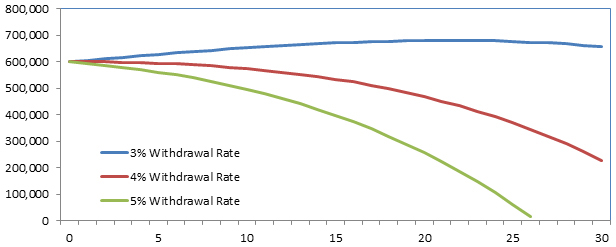

Simulations based on 4% portfolio return, 2% inflation.

One issue to take note of is inflation. Expenses rise over time due to inflation, even if you are consuming the same amount of goods and services. Someone who is younger should account for more inflation than someone who is close to or at retirement. For example, if someone has ten years to go before retirement and is looking to achieve a $2,000 per month income in today’s dollars, he/she should aim for a retirement income of $2,400, assuming a 2% per annum inflation rate.

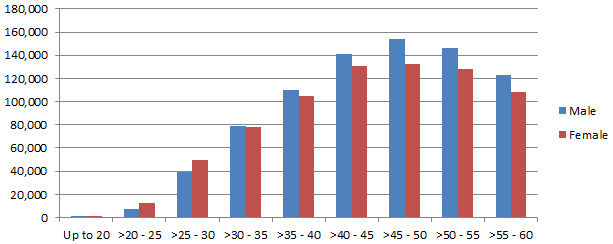

For Singaporean residents, are your Central Provident Fund (CPF) savings sufficient for your retirement? Based on 2016 data from the CPF board, the average CPF member aged 50-55 had about $137,000 in their CPF. Assuming the average CPF member accumulates up to $150,000 by age 55, he/she will receive CPF LIFE payouts of between $1,000-$1,200 per month from age 65. That would only be sufficient to replace 23%-28% of the median monthly income in Singapore. With inflation and escalating healthcare costs as one ages, there is certainly a need save and invest additional funds towards an adequate retirement fund.

Source: CPF, UOB Kay Hian. Note: Figures based on 2016 data.

Source: CPF, UOB Kay Hian. Note: Figures based on 2016 data.

Whether you are planning for a 10- or 50-year retirement, you can create portfolios using UTRADE Robo which are customized for your personal needs, following which the portfolio will be managed according to those needs. Use our portfolio simulator to see if you are on track to reach your retirement goal!

Create your retirement portfolio today!